Author Archives: pip_admin

Understanding Personal Bankruptcy in Dublin: A Comprehensive Guide

In times of financial distress, when debts seem insurmountable and options scarce, understanding the path to a fresh start becomes paramount. Personal bankruptcy can offer a viable solution for those navigating overwhelming debt burdens in Dublin. This comprehensive guide sheds light on the intricacies of personal bankruptcy, presenting a lifeline to financial recovery.

Personal bankruptcy is a legal process designed to provide individuals drowning in unmanageable debt with a structured solution. Bankruptcy allows individuals to address their financial difficulties while ensuring fairness for both debtors and creditors.

Bankruptcy in Dublin: You’re Solution

For Dublin residents facing financial turmoil, personal bankruptcy can be the way forward. It offers a structured process for debt relief, allowing individuals to reorganize their finances and make a fresh start.

Navigating Bankruptcy: A Step-by-Step Process

Assessment: Start by evaluating your financial situation. Collaborate with professionals who specialize in personal bankruptcy solutions, like us at PIPLtd.ie.

Debt Management Plan: Explore alternatives to bankruptcy, such as debt management plans. If

bankruptcy is the best option, proceed to the next step.

Filing for Bankruptcy: Engage with legal experts to prepare and file bankruptcy petitions accurately. Automatic Stay: Once filed, an automatic stay halts creditor actions, providing relief and space to formulate a repayment plan.

Repayment or Discharge: Depending on the bankruptcy chapter and circumstances, work towards repaying creditors through a court-approved plan or have qualifying debts discharged.

The Human Touch: You’re Guide to Financial Recovery

At PIPLtd.ie, we understand the emotional strain that financial troubles can bring. Our empathetic experts provide personalized guidance through the intricate process of personal bankruptcy in Dublin. We ensure that you comprehend the legal nuances, make informed decisions, and embark on a journey towards financial stability.

In conclusion, it’s essential to approach the process with understanding and a human touch, supported by professionals who genuinely care about your financial recovery. At PIPLtd.ie, we stand beside you, guiding you through the complexities of bankruptcy with a commitment to your well-being and financial rejuvenation.

Navigating Financial Hardships: Expert Bankruptcy Solutions in Dublin

Life’s journey can sometimes lead us through unexpected financial challenges. During these testing times, seeking expert guidance becomes paramount. That’s where Bankruptcy Dublinsteps in, offering specialized solutions to address personal bankruptcy issues with the aim of aiding individuals in Dublin on their path to financial recovery. Partnering with www.pipltd.ie, Bankruptcy provides a reliable platform for accessing essential financial advice services.

When facing the daunting prospect of personal bankruptcy, it’s crucial to have a personalized approach. Bankruptcy Dublin understands this, and their services are tailored to cater to the unique circumstances of each individual. With a commitment to avoiding keyword stuffing and instead focusing on quality guidance, the team at Bankruptcy Dublin ensures that individuals receive expert assistance without unnecessary jargon.

Unlike generic advice, the guidance available here is rooted in a deep understanding of the local financial landscape. The dedicated team atPersonal Bankruptcy Dublin acknowledges that bankruptcy is not a one-size-fits-all situation. With a commitment to facilitating informed decisions, they equip individuals with personalized insights that enable them to chart a clear course towards financial recovery.

The collaboration with www.pipltd.ie adds another layer of credibility to Bankruptcy Dublin’s services. The expertise brought forth by this partnership creates a comprehensive resource for individuals in Dublin seeking Personal Bankruptcy solutionsto their financial hardships. By maintaining a keyword density of 1%, the content on their website offers valuable insights that are easy to comprehend and apply.

Bankruptcy doesn’t have to be the end of the road; it can mark the beginning of a journey towards financial stability. Bankruptcy, in association with www.pipltd.ie, opens the door to effective strategies, offering a beacon of hope for those navigating the complexities of personal bankruptcy. With a focus on providing genuine assistance, their expert guidance shines a light on the path to financial recovery.

What You Need to Know About Personal Insolvency Arrangements at Estuary House

If you are struggling with debt, you may have heard of personal insolvency arrangements (PIAs) as an alternative to bankruptcy. Personal Insolvency Ltd at Estuary House, Dublin is a service that can provide PIA and personal bankruptcy help in Dublin. Here’s what you need to know about PIAs and how Personal Insolvency Practitioners at Estuary House can assist you.

PIAs are a formal legal arrangement between you and your creditors to restructure your debt. They are designed for people who are insolvent, meaning they are unable to pay their debts as they become due. PIAs allow you to make affordable payments over a set period of time, usually five or six years, to reduce your debt.

One advantage of a PIA over bankruptcy is that it allows you to keep certain assets, such as your home or car, as long as you can afford to make the payments. In contrast, bankruptcy may require you to sell off some of your assets to pay back your creditors.

Personal Insolvency Practitioners can guide whether a PIA is right for you and help you through the process. Their qualified, professional financial advisors can help you prepare the necessary paperwork and negotiate with your creditors to get the best possible terms.

Personal Insolvency Practitioners may also help you understand the procedure and what it entails if you are contemplating bankruptcy. They can help you determine whether bankruptcy is the right choice for you and guide you through the process if you decide to pursue it.

Hence, if you’re battling with debt and considering PIA & Bankruptcy, Personal Insolvency Ltd at Estuary House can be of great aid. You can find the best course of action and recover control of your financial condition with their assistance. Don’t hesitate to reach out at PIPLtd.ie and get the help you need today.

Landmark Personal Insolvency Case

A Personal Insolvency Arrangement was contested by a Vulture fund and so was sent by PIP for a Section 115A Court Review, to the High Court.

Judge Baker in the High Court, enforced the coming into effect of the Personal Insolvency Arrangement, which reduced the Mortgage from €48,1857 to €21,7500 and wrote off Unsecured loans and Credit Card debt of 7 million Euro.

There was a term extension on the Mortgage, and the Mortgage rate was fixed at 1.25% for the remaining 21 years of the life of the Mortgage.

The home was not a Trophy home and was suitable for the needs of the Family.

The PIA was a better outcome than Bankruptcy.

The Vulture Fund was Promontory Oyster DAC.

Ruling was delivered on February 19th 2018.

The Mortgage was in Arrears as at 1/1/2015, which is essential in order to get a Section 115A Court review.

A general introduction to bankruptcy:

Here at PIP Ltd we are compiling a series of blog posts based on the most common questions we get asked about bankruptcy. Over the coming weeks we will be answering questions. We endeavor to break them down into 3 sections:

- A general introduction to bankruptcy

- How do you declare bankrupt? What is the process?

- What happens during and after bankruptcy.

If you have any topics you would like us to include as a part of our series on bankruptcy email us at info@pipltd.ie and we will do our best to include them.

A general introduction to bankruptcy:

What is bankruptcy?

According to the ISI “Bankruptcy is a process where the ownership of an insolvent person’s property transfers to the Official Assignee in Bankruptcy to be sold by him for the benefit of those to whom the individual owes debts (creditors).” If you are going bankrupt all your assets are transferred to the official Assignee in Bankruptcy. This brings us on to the next question.

What is the role of the Official Assignee of Bankruptcy?

The role of the Official Assignee is to investigate the full extent of your property, sell or otherwise dispose of your property and distribute the proceeds to your creditors.

Who is the official assignee of bankruptcy?

Chris Lehane is the civil servant who serves as the Official Assignee in bankruptcy. He is a court appointed official who is put in charge of the property and assets of bankrupt individuals.

What does bankruptcy mean?

All assets are gone and all debts are gone, from the date of Adjudication.

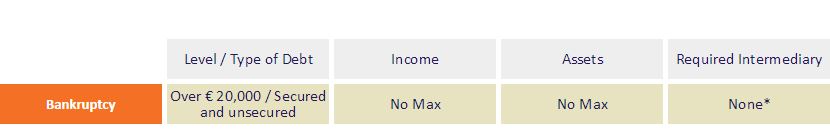

How much debt do I need to have to go bankrupt?

An insolvent person needs to have over €20,000 debt both secured and unsecured

How much does it cost to declare bankruptcy?

Chris Lehane, on behalf of the Government charges €200 to open your case file and your intermediary, if you require one, will have their fees.

Is it possible to remain in your home after declaring bankruptcy?

Yes it is possible to remain in your home after Bankruptcy if you can pay the repayments which are agreed with your Mortgage holder.

How long does it take to go bankrupt?

Bankruptcy can be done within six weeks via high court proceedings.

How long does bankruptcy last?

Bankruptcy lasts one year in Ireland. Before 2013 it was 12 years so it is now a very popular option.

How do I apply for bankruptcy?

Both MABS and the ISI recommends that anyone thinking of applying for bankruptcy seek legal advice. We advise you to talk to a Personal Insolvency Practitioner. We are experts and can guide you through this process making it as a stress free as possible.

Click on the guides below to download further information about Bankruptcy.

Free Help with Debt on Feb 18th, Clarion Hotel, Liffey Valley

If you’re in financial difficulties, the ISI is offering you a free confidential debt advice meeting with a Personal Insolvency Practitioners / Approved Intermediaries – the expert advisors regulated by the ISI.

This event will take place in the Clarion Hotel, Liffey Valley Dublin on Saturday February the 18th 2017.

Book your appointment now. Phone the ISI on 076 106 4200 or freetext ISI Event to 50015.

Visit backontrack.ie for more information

Abhaile, The Mortgage Arrears Scheme

The Government has set up a new scheme to help people who are are at risk of losing their homes due to mortgage arrears.

The Abhaile Scheme aims to ensure that a person in this situation can access free, independent expert financial and legal advice and support. People who need help will be given vouchers so they can afford to get expert advice from financial and legal advisers.

As a part of the Abhaile Scheme they can get assistance in court where needed, have access to solicitors, and get help obtaining legal aid. They can also get financial advice from a dedicated mortgage arrears adviser, a personal insolvency practitioner (PIP), or an accountant.

“The overall objective of the Scheme is to ensure that a person in this situation can access free, independent expert financial and legal advice and support, which will help them to identify and put in place their best option to get back on track. Priority is given to finding solutions which will allow the person to remain in their home, wherever that is a sustainable option. ” source Welfare.ie

If you are interested in participating in the Abhaile Scheme your first port of call is Mabs. They will direct you to on how to proceed. The expert help is provided free under a “voucher” issued by MABS, working with the Insolvency Service of Ireland, the Legal Aid Board and the professional accountancy bodies.

More information on the Abhaile Scheme can be downloaded here.

Highlights from the ISI statement to the Oireachtas Committe on homelessness

The Insolvency Service of Ireland presented some very interesting statistics to the Oireachtas Commitee on homelessness on May the 17th.

You can download the full statement from the ISI website here.

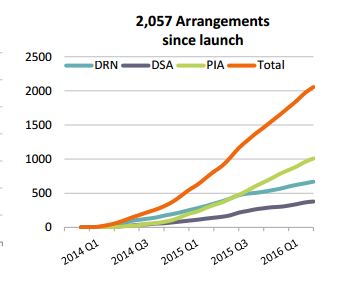

In the graph below we can see the number of debt solution arrangements that have been sought since the launch of the ISI in 2014

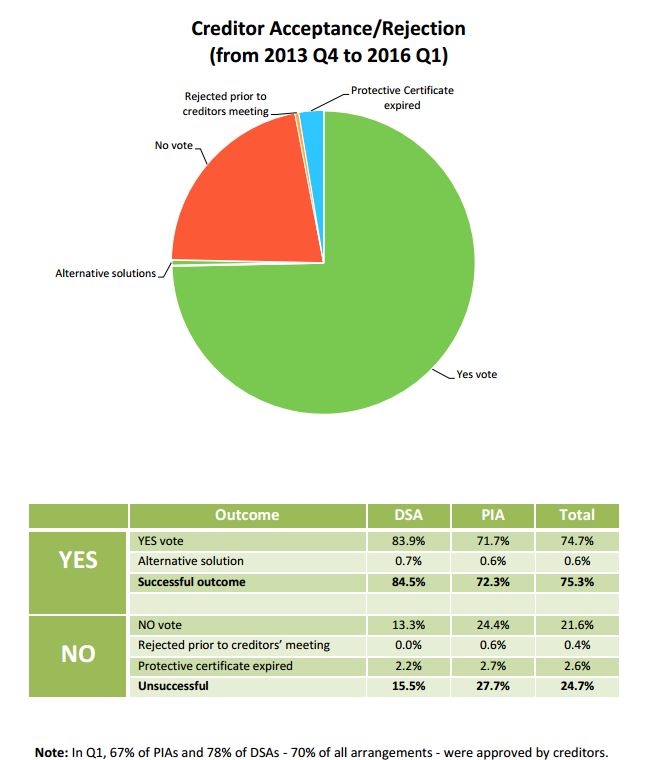

The following chart and table gives us a breakdown of creditor acceptance of arrangements.

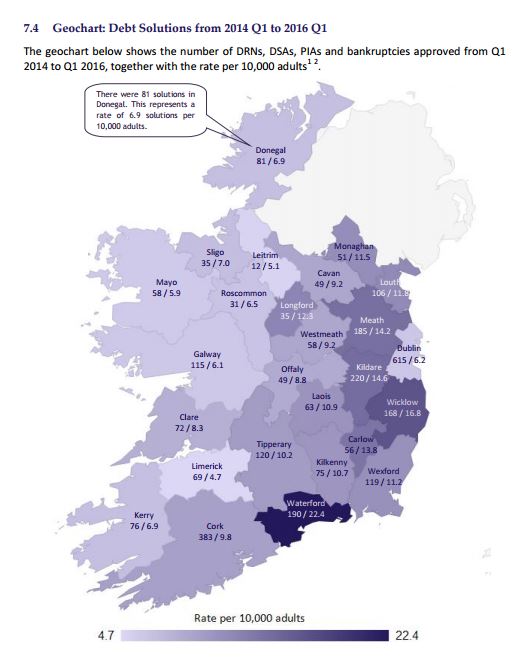

The map below gives us a breakdown of the number of DRNs, DSAs, PIAs and Bankruptcies by county since the inception of the ISI in 2014.

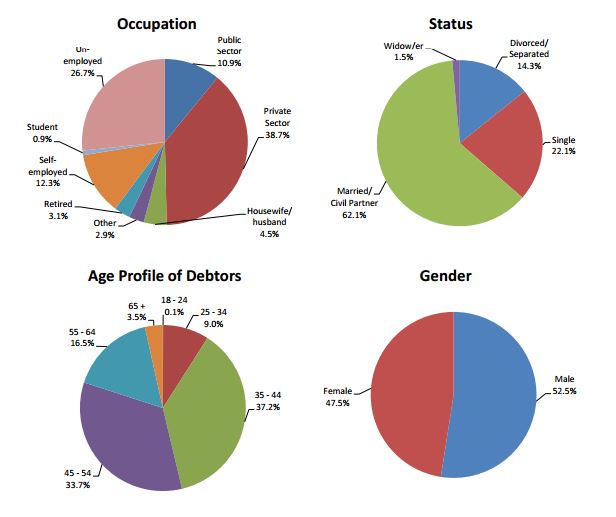

The following chart profiles the people who are seeking debt solutions.

Profile of a PIP: William Fitzpatrick

What inspired you to become a Personal Insolvency Practitioner?

I have worked for 24 years in accounting practice and during the last few years I have been dismayed by the sheer numbers of people getting into difficulty repaying their debts after the property crash in 2008. My heart went out to all the people in crisis whose personal lives had been rocked to the core. I saw that these people tended to be hugely intimidated by their creditors and by the process banks enter into to seek repayment. I set up PIP Ltd to help those people. I knew that very often it is only a PIP that can keep a family in the family home (principal primary residence) despite their debt and wanted to be able to do that.

How did you become a Personal Insolvency Practitioner?

To become a PIP you must be authorised and registered with the Insolvency Service of Ireland. I fit one of the pre-requisites of becoming a PIP as I was already a qualified accountant. I also had to complete a course with the Insolvency Service of Ireland and pass an exam relating to insolvency law in Ireland. Other than the formal qualification I feel that it is the mutual respect that I have gained from both clients and financial institutions that has made me an effective personal insolvency practitioner.

What advice would you give someone who has debt problems?

My advice is to seek advice, whether it is through a PIP or a financial advisor or through an organisation like backontrack.ie. Debt can be crippling and wreaks havoc on peoples’ lives. Often it can feel like it is spiralling out of control. If you start the process of looking for help it can offer great relief as it is the first step on the road to creating a solution for your debt.

What is the hardest part of being a PIP?

The most difficult part of being a PIP is seeing the effects of debt on an individual.  It can cause huge amounts of worry and stress and has a massive effect on a person’s mental health.

What is the best part of being a PIP?

The best part of being a PIP is letting clients know that a debt solution has been agreed upon. It is very often as though the weight of the world has been lifted off their shoulders. Banks are now writing off debt for the average person and one of our best results so far was getting a loan of €490,000 reduced to €170,000.

What do you like to do to unwind from the pressures of being a PIP?

I am a cyclist. Nothing like a long cycle to clear your head after a week in the courts or dealing with banks!

If you would like to talk to William you can contact him here.

ISI announce Personal Insolvency Arrangements are Popular Solutions

On the 19th April the Insolvency Service of Ireland published their quarter 1 statistical report for 2016. It announced continued growth in all key areas.

Personal Insolvency Arrangements (the solution designed to keep people in their family homes) are the most popular solution.

The report tells us that there is:

- Continued growth in new applications, protective certificates and approved arrangements

- New applications for PIAs (the solution designed to keep people in their family home) up

26% - Bankruptcy numbers falling

Since the ISI opened they have helped over 3000 people, 1,009 PIA, 379 DSA, 669 DRN, 1,096 bankruptcy and have dealt with debt of almost €5 billion.

A copy of the ISI’s Q1 Statistical Report for 2016 is available for download here.

Commenting on the statistical report, Mr. Lorcan O’Connor, Director of the ISI, noted that “the 26% growth in PIA applications is likely due to the newly introduced Court Review process, sometimes referred to as the removal of the “bank vetoâ€.

Mr. O’Connor encouraged anyone with serious debt issues to consult a Personal Insolvency

Practitioner.